Metals

U.S. FIAT MONETARY SCAM: $100 Bill vs Gold

by Steve St. Angelo, SRS Rocco Report:

The biggest scam in history continues as the U.S. Department of Treasury Bureau of Printing and Engraving floods the world with worthless fiat currency. Of course, all countries now have fiat currencies, however the U.S. Federal Reserve Note is still the world’s reserve currency.

The growth of U.S. currency in circulation has been considerable over the past twenty years. According to the Federal Reserve Statistical Release, the total value of Federal Reserve Notes in circulation jumped from $423 billion in 1996 to $1.38 trillion as of October 8th, 2015. This was a staggering 228% increase even though the population of the United States only increased 21% during the same time period.

The huge increase of U.S. currency in circulation over this twenty-year period was due to two reasons:

- Under reporting inflation, thus leading to a larger amount of currency in circulation

- the exporting of U.S. Dollar’s (and U.S. inflation) overseas where a larger percentage is held in foreign hands.

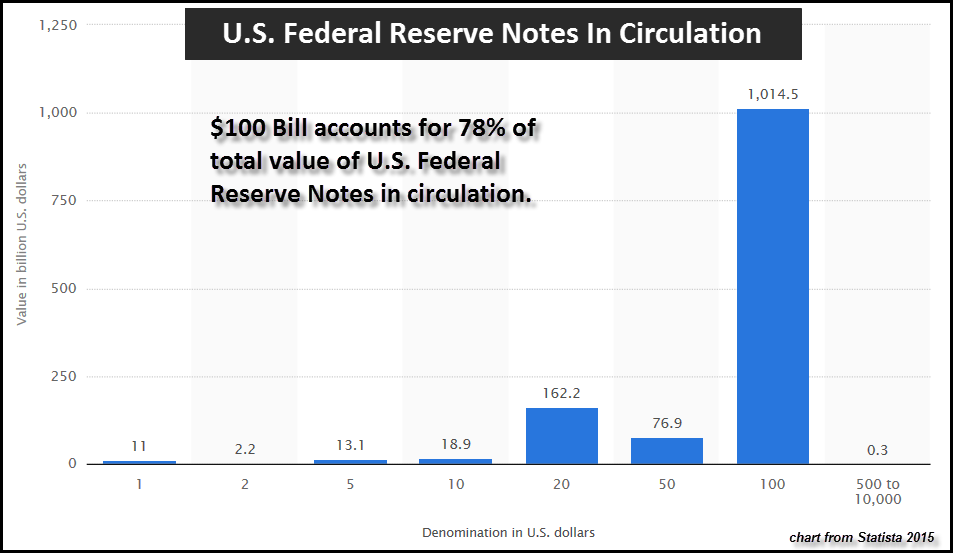

To get an idea of the breakdown in U.S. currency in circulation, let’s look at the following chart from Statista 2015:

As we can see, the $100 bill accounts for $1,014 billion (78%) of the total $1,341 billion of Federal Reserve Notes in circulation. The data in this chart was complied on Dec 31st, 2014. Over the past eight months, total U.S. currency in circulation grew an additional $47 billion to $1,388 billion ($1.38 trillion).

Looks like business is doing very well for the folks at the U.S. Department of Treasury Bureau of Engraving and Printing. Why would the world need an extra $47 billion of Federal Reserve Notes if economic activity has been declining?? Maybe Americans and especially foreigners prefer real cash in hand, or it could be due to the continued debasement of the almighty Dollar.

U.S. $100 Dollar Printing vs Gold Production

To get an idea just how worthless U.S. currency is compared to gold, let’s focus on the $100 bill. Again, the $100 billion represents 78% of all outstanding Federal Reserve Notes in circulation.

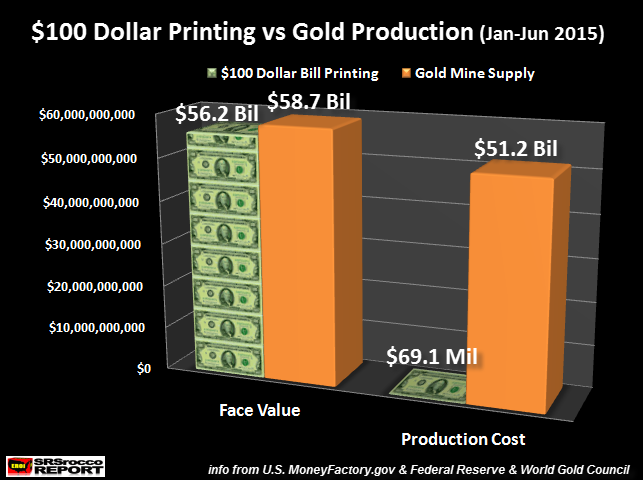

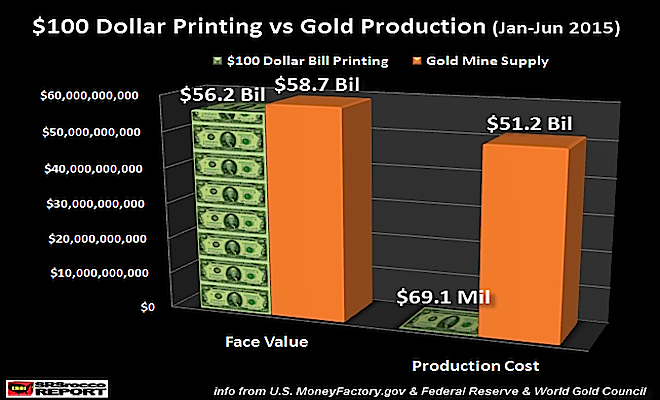

Total world gold production during the first six months of the year was 48.7 million oz (Moz)–World Gold Council Q2 2015 Gold Demand Trends. Compare this to the total 562 million $100 bills printed by U.S. Treasury during the same time period. Thus, the total value of $100 bills printed JAN-JUN 2015 was $56.2 billion versus the total market value of gold production of $58.7 billion.

So, here we can see that the face value (market value) of these two currencies were about same. However, the cost of production were drastically different:

If we assume the U.S. gold industry’s average cost of production is $1,050 an ounce, total cost to produce the 48.7 Moz was $51.2 billion. Now, according to the Federal Reserve, the cost to produce a new $100 bill is 12.3 cents a note. Thus, the total $56.2 billion face value of $100 bills cost a lousy $69.1 million to print.

While it’s true that the Federal Reserve collects older worn-out bills and exchanges them with freshly minted bills, total U.S. currency in circulation grew $47 billion in the first eight months of the year… with the majority being $100 bills.

Furthermore, the Federal Reserve stated this about its 2015 Fiscal Year currency print order for the U.S. Treasury:

The estimated number of notes that Reserve Banks will destroy accounts for nearly 85 percent of the proposed FY 2015 print order and includes both unfit currency, as well as all old-design $100 notes received from circulation.

The Federal Reserve will receive $188.5 billion (nearly 70% as $100 bills) in new U.S. bills from the Treasury Fiscal Year 2015. If the Federal Reserve will only destroy 85% of old notes, this leaves an extra $28 billion notes left over. However, total currency in circulation has already grown by $47 billion JAN-SEP 2015.

For some strange reason, the numbers don’t jive. Either way, the Federal Reserve continues to add increasing worthless fiat currency at a cost of 12.3 cents each $100 note. Thus, the $56.2 billion of $100 bills printed in the first six months of 2015 cost the Federal Reserve $69.1 million compared to the estimated $51.2 billion to produce total world gold production.

Which means, (12) $100 bills (12.3 cents each) cost the Federal Reserve a total of $1.48, compared to an ounce of gold at $1,050. An individual can take those (12) $100 bills and purchase an ounce of gold now valued at $1,160. As we can see, the Federal Reserve is the clear winner as cheapest producer of currency by a wide margin compared to gold.

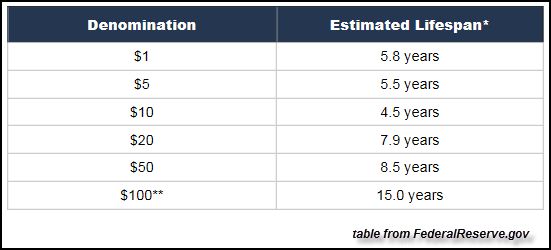

In addition, the Federal Reserve won’t have to exchange as many $100 bills in the future as the estimated lifespan of the $100 note is 15 years:

The double asterisk on the new $100 bills states the Federal Reserve does not yet have an estimated lifespan due to the new anti-counterfeit bill that was released on Oct, 2013. That being said, I would imagine the new $100 bill was designed to last similar to the 15 year lifespan of the old bill.

Read More @ SRSRoccoReport.com