www.bewustnieuws

www.bewustnieuws

Economy

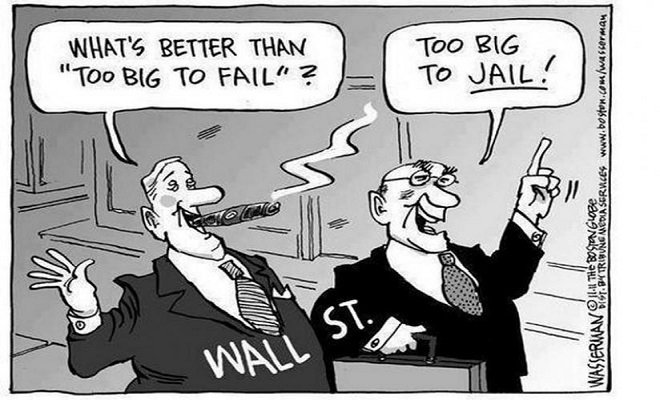

“Too Big To Fail Is A License For Recklessness” America’s Banking System Is A “Fragile House Of Cards”

by Lynn Parramore The Institute for New Economic Thinking, via Zero Hedge.com:

Anat Admati teaches finance and economics at the Stanford Graduate School of Business and is co-author of The Bankers’ New Clothes, a classic account of the problem of Too Big to Fail banks. On May 6th, at the Finance and Society Conference sponsored by the Institute for New Economic Thinking, she will join Brooksley Born, former chair of Chair of the Commodities Futures Trading Commission, to discuss how effective financial regulation can make the system work better for society. Seven years after the worst financial crisis since the Great Depression, Admati warns that we are not doing nearly enough to confront a bloated, inefficient, and dangerous financial system. The system can’t fix itself. Here’s what you need to know.

Lynn Parramore: How would you describe the problem of Too Big to Fail banks. Whey does it matter to an ordinary person?

Anat Admati: Too Big to Fail is a license for recklessness. These institutions defy notions of fairness, accountability, and responsibility. They are the largest, most complex, and most indebted corporations in the entire economy.

We all have to be really alarmed by the fact that not only do we still have such institutions, but many of them are ever-larger and more complex and at least as dangerous, if not more so, than they were before the financial crisis.

They are too big to manage and control. They take enormous risks that endanger everybody. They benefit from the upside and expose the rest of us to the downside of their decisions. These banks are too powerful politically as well.

As they seek profits, they can make wasteful and inefficient loans that harm ordinary people, and at the same time they might refuse to make certain business loans that can help the economy. They can even break the laws and regulations without the people responsible being held accountable. Effectively we’re hostages because their failure would be so harmful. They’re likely to be bailed out if their risks don’t turn out well.

Ordinary people continue to suffer from a recession that was greatly exacerbated or even caused by recklessness in the financial system and failed regulation. But the largest institutions, especially their leaders — even in the failed ones — have suffered the least. They’re thriving again and arguably benefitting the most from efforts to stimulate the economy.

So there’s something wrong with this picture. And there’s also increasing recognition that bloated banks and a bloated financial system – these huge institutions—are a drag on the economy.

LP: Have we made any progress in dealing with the problem?

AA: The progress has been totally unfocused and insufficient. Dodd-Frank claims to have solved the problem and it gives plenty of tools to regulators to do what needs to be done (many of these tools they actually already had before). But this law is really complex and the implementation of it is very messy. The lobbying by the financial industry is a large part of the reason that the law has been implemented so poorly and inefficiently with so much difficulty. We are failing to take simple steps and at the same time undertaking extremely costly steps with doubtful benefits.

So we’ve had far from enough progress. We are told things are better but they are nowhere near what we should expect and demand. Much more can be done right now.

LP: Banks, compared to other businesses, finance an enormous portion of their assets with borrowed money, or debt – as much as 95 percent. Yet bankers often claim that this is perfectly fine, and if we make them depend less on debt they will be forced to lend less. What is your view? Would asking banks to rely more on unborrowed money, or equity, somehow hurt the economy?

AA: Sometimes when I don’t have time to unpack everything I use a quote from a book called Payoff: Why Wall Street Always Wins by Jeff Connaughton. He relates something Paul Volcker once said to Senator Ted Kaufman: “You know, just about whatever anyone proposes, no matter what it is, the banks will come out and claim that it will restrict credit and harm the economy…It’s all bullshit.”

Here’s one obvious reason such claims are, in Volcker’s vocabulary, bullshit: Lending suffered most when banks didn’t have enough equity to absorb their losses in the crisis — and then we had to bail them out.The loss they suffered on the subprime fiasco was relatively small by comparison to losses to investors when the Internet bubble burst, but there was so much debt throughout the system, and indeed in the housing markets, and so much interconnection that the entire financial system almost collapsed. That’s when lending suffered. So lending and growth suffers when the banks have too little equity, not too much.

Now, banks naturally have some debt, like deposits. But they don’t feel indebted even when they rely on 95 percent debt to finance their assets. No other healthy company lives like that, and nobody, even banks, needs to live like that — that’s the key. Normally, the market would not allow this to go on; those who are as heavily indebted feel the burden in many ways. The terms of the debt become too burdensome for corporations, and reflect the inefficient investment decisions made by heavily indebted companies. But banks have much nicer creditors, like depositors, and with many explicit and implicit guarantees, banks don’t face trouble or harsh terms. They only have to convince the regulators to let them get away with it. And they do.

So the abnormality of this incredible indebtedness is that they get away with it. There’s nothing good about it for society. If they had more equity then they could do everything that they do better —more consistently, more reliably, in a less distorted fashion.

Today’s credit market is distorted. A key reason is that bankers love the high risk and chase returns. They are less fond of some of the lending where they are needed the most — like business lending, for example. Instead, most people get many credit cards in the mail and too many people live on expensive revolving credit. Effectively, the poor may end up subsidizing the credit card of the person who pays on time and has zero interest (and we all end up paying the enormous fees merchants are charged). So we can have too much or too little lending and live through inefficient booms and busts. Part of the reason for that is that banks are continually living on the edge in a way that nobody else in the economy would, and regulations meant to correct it are insufficient and flawed in their design.

LP: Banking has been a very profitable business. Is it profitable because the risks are born by the taxpayer? Do you think the bank bonus system is part of the problem?

AA: Yes, banking is partly profitable because of subsidies from taxpayers. There are probably other reasons, and not all of them good ones, in terms of the way competition works and other things. The bonus system encourages recklessness, and recklessness increases the value of the subsidies from taxpayers. Bankers are effectively paid to gamble.

It is profitable for the banks to become big even when this is inefficient, because they can do so with subsidized borrowing on easy terms. Guarantees, explicit and implicit, are a form of free or subsidized insurance. We don’t control whether what banks do with the cheap funding benefits the economy or just bankers and some of their investors. We must reduce these large subsidies that end up rewarding recklessness and harming us. (See Admati’s July 2014 testimony before Congress on bank subsidies).

LP: We often hear about financial innovations that helped bring the global economy to its knees in 2008. Back in December, Congress rolled back a key taxpayer protection concerning derivatives, which Robert Lenzner of Forbes Magazine called a “Christmas present for the banks.” What do Americans need to know about derivatives? How do they affect the Too Big to Fail problem?

AA. The Christmas present was just one more small thing in a much bigger problem. The largest financial firms in America can hide an enormous amount of risk in derivatives. That’s very dangerous because it makes banks more interconnected, since much of the derivatives trading happens within the financail system. It creates a house of cards — a very fragile system.

We also have bankruptcy laws in this country that perversely give unusual priority to derivatives contracts and other reckless practices.

Derivatives exacerbate Too Big to Fail dramatically because there’s so much opacity in the system. Policy-makers get scared into bailing our or guaranteeing a lot of their commitments made in those markets because they won’t quite know the consequences of letting them fail. It’s very intimately related to Too Big to Fail. It’s as if they hold a gun to your head. You don’t konw whether they have bullets so you may get scared into paying the ransom.

LP: Is breaking up the banks is a solution?

AA: People say those words but what does it mean? How would you do it? That’s the big problem. Banks are multiple times bigger than most of the corporations you think of as big. I once made a mistake rushing through a HuffPost piece in 2010 saying that Jamie Dimon wants to be as big as Walmart. Well, at the time, JP Morgan was already 10 times bigger than Walmart by assets! When it comes to the financial sector, big is really big. People don’t even appreciate how big we’re talking about. Nobody else gets to be as big, and in fact, In other parts of the economy, companies that get so big often break up on their own. But that doesn’t happen in banking partly because of the perverse subsidies taxpayers provide.

The most sensible approach is to force banks and other financial institutions to have more equity, which is actually going to expose their inefficiencies and bring more investor pressure for a break-up to happen naturally without us doing it actively. Regulators can also put significantly more pressure on banks to simplify their structure and divest unnecessary lines of businesses such as commodities (energy, aluminum, etc.). The size appears unmanageable and makes regulation difficult.

LP: What would make banking regulation more effective?

AA: First of all there could be simpler regulation in some places and some cost-ineffective things could be used a bit less. Right now, we know too little about the risk and we have too little margin for error. We must reduce the opacity and increase the safety margins dramatically. Regulators make it complicated because we are unnecessarily living at the edge of a cliff all the time. We live so dangerously! There’s no need for that. We are told that we have to live like that, but it’s that’s completely false. The system has to be made a lot more resilient. Then we can worry less and sleep better.

In addition to making things simpler, it’s very important that we are able to see more of the risk and then to enforce much stronger and simpler rules. And, of course, regulators need to be watching where the risks are going. They should not believe that just because the risks are off the accounting balance sheets that they are gone. That was a trick to get around regulations and get around accounting rules in cases like Enron. A lot of the risks were hiding — but they can be traced. Some laws that are counterproductive and make regulation harder should also be examined, including the tax code that encourages debt over equity, and the bankruptcy law that overly protects certain financial practices.

LP: If we don’t deal with the problem of Too Big to Fail, what happens?