image: silverdoctors.com

image: silverdoctors.com

Metals

The Precious Metals Look Good in the Years Ahead

from Brad Sebion, MoneyandTrading.com, SGTreport.com:

At the moment gold has no defined trend and silver is in a downtrend. All the markets around the world, with the exception of Egypt, are in uptrends. However, there are a lot of reasons to remain bullish on the metals in the years ahead.

The dollar is trading at a fourteen month low, currently priced at 93 on the US dollar index. It is no secret President Trump wants a cheap dollar during his presidency. Mario Draghi and the Bank of Japan are taking the same stance. They will keep money cheap and credit plentiful to keep the markets on course. Current fed policy makes it is highly likely the next rate hike in the US will not happen in the months ahead.

Investors should take notice of the gold and silver commitment of trader’s reports. The commercial banks have the lowest short exposure in some time. What are the chances the metals market gets taken down over a holiday, when the volume is low, and the commercial banks are right there getting rid of their short exposure. Very rarely are they wrong. At the end of March you could see the commercials heavily short the metals and a few weeks later the price of gold was capped at $1290 and silver topped out at $18.50. Today the reverse is happening.

[Got PHYSICAL?]

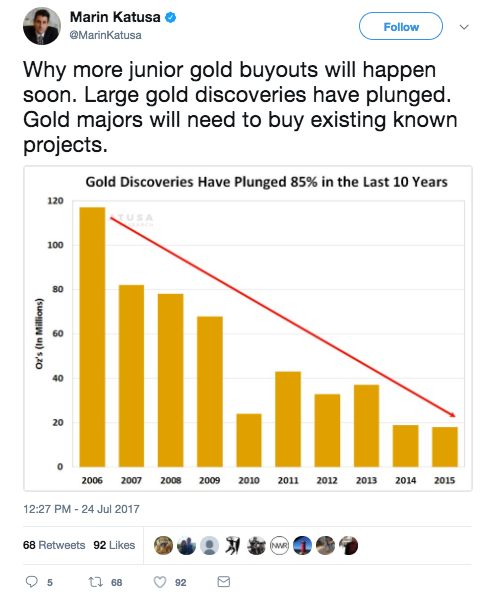

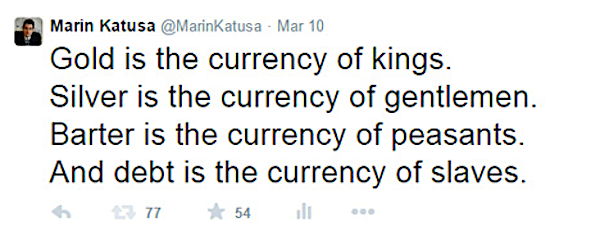

Marin Katusa released a gold tweet towards the end of July. Katusa highlighted the continuing lack of discovery of new deposits. The chart he shared on twitter indicated gold discoveries are down 85% in the past ten years, and gold reserves continue to decrease. Since this is trend remains more buyouts of junior mining companies are imminent. Marin Katusa’s Gold Tweet:

I believe in the future, more profits from the crypto currencies are going to be taken and some of that capital will flow into the precious metals. Companies like Euro Pacific Capital accept bitcoin as payment. Once the transaction is completed, bitcoin is converted into us dollars. Financial technology will continue to improve and more companies will transact in cryptocurrencies, even if they oppose the concept.

Corporate bond debt has reached over 45% of GDP according to Federal Reserve statistics. The same peak levels were reached during the dot com bubble in 2001 and the housing bubble in 2008. Alan Greenspan recently made comments inferring the bond market is where the trouble is. The first sign of bonds rolling over may cause the conservative investor to move in the direction of the precious metals.

Today commodities are trading at a record low levels compared to the S&P 500 according to the GSCI commodity index. Levels this low have only been reached in the early 1970s and in the late 1990s. John Maynard Keynes was correct is saying “Markets can stay irrational longer than you can stay solvent.

If one wants to take a position in the metals market, I would advise to watch the gold miners etf (GDX). In February of 2017 a large amount of volume came into the market and moved the price up quickly. This will happen again. Don’t try to catch the falling knife and try to guess where the bottom is, let the big volume and rising sediment tell you when to buy.

To an extent the markets are rigged. That being said, men can only manipulate markets for so long before the market overwhelms them. History bears this out over and over. If you have exposure to the metals market, stay patient.

SGT NOTE: Lynette Zang agrees with Clif too, precious metals are worth FAR more than what they sell for now, and the COLLAPSE has been happening for years, in slow motion.

https://www.youtube.com/watch?v=qnFr1ttmFKI