Metals

U.S. GOLD MARKET TROUBLE: No Supply When Price Skyrockets

from SRS Rocco:

Americans are in big trouble and they don’t even know it. The financial system in which they are totally invested, is heading towards an epic collapse. Printing money and increasing debt (exponentially) are not sustainable business practices. These artificial techniques to prop up a Zombie Economy have a certain lifespan… one that will end much sooner than later.

Unfortunately, the precious metal community had no idea how long the Fiat Monetary Authorities could prop up the Leech & Spend U.S. Economy. Many now believe this can go on for quite a long time. However, this is a terrible assumption to make. Why? Because the length at which the Fed and member banks were able to keep a Dead Financial System alive and its inevitable collapse, will both come as a surprise.

Many precious metal investors are now under the trance that the Fed and member banks are totally in control of the financial and economic system. The evidence is perfectly clear when we look at physical gold investment demand. According to the World Gold Council’s Quarterly Demand Trend Reports, physical coin and bar investment is down significantly compared to 2013, and will be less than half of what it was in 2011.

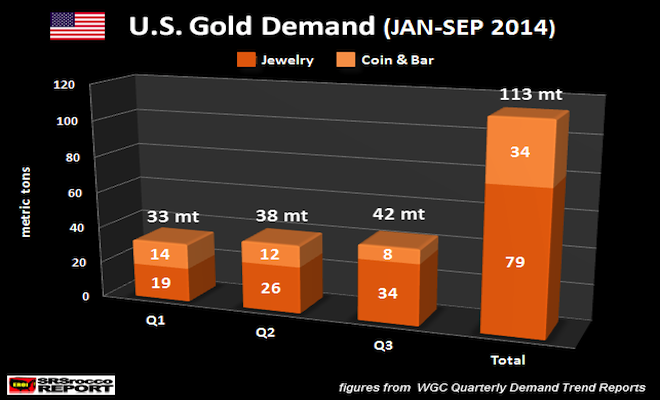

The data from the World Gold Council shows Americans purchased a paltry 34 metric tons (mt) of physical bar and coin and 79 mt of gold jewelry JAN-SEP 2014.

We can see an interesting trend took place in American gold buying habits as the price of gold declined from a high in March to a low in September (2014)… physical bar and coin demand fell while gold jewelry purchases nearly doubled. Thus, physical bar and coin demand fell from 14 mt in Q1 to 8 mt in Q3, whereas gold jewelry demand increased from 19 mt in Q1 to 34 mt in Q3.

What do these gold buying trends reveal? When the price of gold declines, Americans on an increasing basis, (and stupidly so) spend their hard-earned fiat money on gold for adornment purposes, rather than acquiring it as an investment. Let me tell you, when gold was really cheap back in the early 2000’s, Americans were buying gold jewelry at three times the rate they are presently. Then of course, they took that gold jewelry and pawned it off into the scrap market after the severe 2008-2009 economic and financial recession for much-needed cash.