Dollar Ponzi

Preparing For The Collapse Of The Petrodollar System

by Jerry Robinson, FTM Daily:

Recently, there have been many news headlines containing the words “Iran”, “nuclear capability”, “Syria“, and “Islamic State“. If you listen closely, you can almost hear the drumbeats of a fresh war in the Middle East.

As an economist, I have been trained to view the world through the lens of incentives. (I am a “bottom line” kind of guy.) And just as every action is motivated by an underlying incentive, every decision has a related consequence.

This brief article details the actions, incentives, and related consequences that the United States has created through its attempts to maintain global hegemony through something known as the petrodollar system.

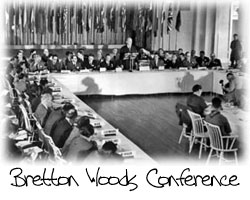

This article will begin with a look back at the important events of the 1944 Bretton Woods Conference, which firmly established the U.S. Dollar as the global reserve currency. Then we will examine the events that led up to the 1971 Nixon Shock when the United States abandoned the international gold standard. We will then consider what may be the most brilliant economic and geopolitical strategy devised in recent memory, the petrodollar system. Finally, we conclude by examining the latest challenges facing U.S. economic policy around the globe and how the petrodollar system influences our foreign policy efforts in oil-rich nations. The collapse of the petrodollar system, which I believe will occur sometime within this decade, will make the 1971 Nixon Shock look like a dress rehearsal.

This article will begin with a look back at the important events of the 1944 Bretton Woods Conference, which firmly established the U.S. Dollar as the global reserve currency. Then we will examine the events that led up to the 1971 Nixon Shock when the United States abandoned the international gold standard. We will then consider what may be the most brilliant economic and geopolitical strategy devised in recent memory, the petrodollar system. Finally, we conclude by examining the latest challenges facing U.S. economic policy around the globe and how the petrodollar system influences our foreign policy efforts in oil-rich nations. The collapse of the petrodollar system, which I believe will occur sometime within this decade, will make the 1971 Nixon Shock look like a dress rehearsal.

If you have never heard of the petrodollar system, it will not surprise me. It is certainly not a topic that makes it’s way out of Washington and Wall Street circles too often. The mainstream media rarely, if ever, discusses the inner workings of the petrodollar systemand how it has motivated, and even guided, America’s foreign policy in the Middle East for the last several decades.

Personal Note: What I am going to explain in this article is something that I believe is vitally important for every American to understand. Since 2006, I have written dozens of articles on the petrodollar system. I have appeared on many major news media outlets talking about the petrodollar system. I even wrote a best-selling book entitledBankruptcy of our Nation that spent an entire chapter exposing the petrodollar system. I have spoken about this topic all over the world. Suffice it to say, I believe that understanding the petrodollar system is very important to your financial well being. I encourage you to print this article out and read it carefully. When you are finished with it, I encourage you to share it with your friends and neighbors. Share it on Facebook and Twitter. Help us get the word out so that the American public can stir from its slumber and begin preparing for what lies ahead.

A Brief Overview of this Article Series on the Petrodollar System

In the final days of World War II, 44 leaders from all of the Allied nations met in Bretton Woods, New Hampshire in an effort to create a new global economic order. With much of the global economy decimated by the war, the United States emerged as the world’s new economic leader. The relatively young and economically nimble U.S. served as a refreshing replacement to the globe’s former hegemon: a debt-ridden and war-torn Great Britain.

In the final days of World War II, 44 leaders from all of the Allied nations met in Bretton Woods, New Hampshire in an effort to create a new global economic order. With much of the global economy decimated by the war, the United States emerged as the world’s new economic leader. The relatively young and economically nimble U.S. served as a refreshing replacement to the globe’s former hegemon: a debt-ridden and war-torn Great Britain.

In addition to introducing a number of global financial agencies, the historic meeting also created an international gold-backed monetary standard which relied heavily upon the U.S. Dollar.

Initially, this dollar system worked well. However, by the 1960’s, the weight of the system upon the United States became unbearable. On August 15, 1971, President Richard M. Nixon shocked the global economy when he officially ended the international convertibility from U.S. dollars into gold, thereby bringing an official end to the Bretton Woods arrangement.

Two years later, in an effort to maintain global demand for U.S. dollars, another system was created called the petrodollar system. In 1973, a deal was struck between Saudi Arabia and the United States in which every barrel of oil purchased from the Saudis would be denominated in U.S. dollars. Under this new arrangement, any country that sought to purchase oil from Saudi Arabia would be required to first exchange their own national currency for U.S. dollars. In exchange for Saudi Arabia’s willingness to denominate their oil sales exclusively in U.S. dollars, the United States offered weapons and protection of their oil fields from neighboring nations, including Israel.

Two years later, in an effort to maintain global demand for U.S. dollars, another system was created called the petrodollar system. In 1973, a deal was struck between Saudi Arabia and the United States in which every barrel of oil purchased from the Saudis would be denominated in U.S. dollars. Under this new arrangement, any country that sought to purchase oil from Saudi Arabia would be required to first exchange their own national currency for U.S. dollars. In exchange for Saudi Arabia’s willingness to denominate their oil sales exclusively in U.S. dollars, the United States offered weapons and protection of their oil fields from neighboring nations, including Israel.

By 1975, all of the OPEC nations had agreed to price their own oil supplies exclusively in U.S. dollars in exchange for weapons and military protection.

This petrodollar system, or more simply known as an “oil for dollars” system, created an immediate artificial demand for U.S. dollars around the globe. And of course, as global oil demand increased, so did the demand for U.S. dollars.