Market Watch

Market Watch

Economy

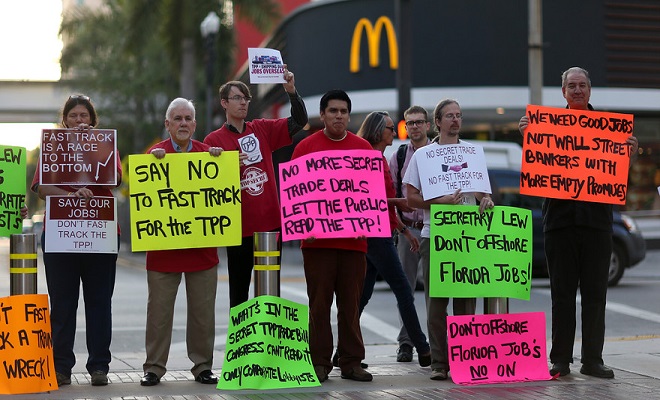

Opinion: The secret corporate takeover hidden in the TPP

Corporations would be able to overturn laws and regulations that protect us

from Market Watch.com:

NEW YORK (Project Syndicate) — The United States and the world are engaged in a great debate about new trade agreements. Such pacts used to be called “free-trade agreements”; in fact, they were managed trade agreements, tailored to corporate interests, largely in the U.S. and the European Union. Today, such deals are more often referred to as “partnerships,” as in the Trans-Pacific Partnership (TPP).

But they are not partnerships of equals: the U.S. effectively dictates the terms. Fortunately, America’s “partners” are becoming increasingly resistant.

Also read: Stiglitz, Warren, De Blasio pitch agenda to tackle inequality.

It is not hard to see why. These agreements go well beyond trade, governing investment and intellectual property as well, imposing fundamental changes to countries’ legal, judicial, and regulatory frameworks, without input or accountabilitythrough democratic institutions.

Perhaps the most invidious — and most dishonest — part of such agreements concerns investor protection. Of course, investors have to be protected against rogue governments seizing their property.

But that is not what these provisions are about. There have been very few expropriations in recent decades, and investors who want to protect themselves can buy insurance from the Multilateral Investment Guarantee Agency, a World Bank affiliate, and the U.S/ and other governments provide similar insurance. Nonetheless, the U.S. is demanding such provisions in the TPP, even though many of its “partners” have property protections and judicial systems that are as good as its own.

The real intent of these provisions is to impede health, environmental, safety, and, yes, even financial regulations meant to protect America’s own economy and citizens. Companies can sue governments for full compensation for any reduction in their future expected profits resulting from regulatory changes.

This is not just a theoretical possibility. Philip Morris PM, -0.25% is suing Uruguay and Australia for requiring warning labels on cigarettes. Admittedly, both countries went a little further than the U.S., mandating the inclusion of graphic images showing the consequences of cigarette smoking.

The labeling is working. It is discouraging smoking. So now Philip Morris is demanding to be compensated for lost profits.

In the future, if we discover that some other product causes health problems (think of asbestos), rather than facing lawsuits for the costs imposed on us, the manufacturer could sue governments for restraining them from killing more people. The same thing could happen if our governments impose more stringent regulations to protect us from the impact of greenhouse-gas emissions.