Image: valuebin.files.wordpress.com

Image: valuebin.files.wordpress.com

Economy

HFT Sues Other HFTs For “Egregious Manipulation” Of Treasury Securities

Parasite Turns On Parasite

by Tyler Durden, via Zero Hedge.com:

There was a time when those who dared to call out the massive Libor manipulation conspiracy (such as what Zero Hedge did with one of its first posts in 2009) for being a massive Libor manipulation conspiracy some 4 years before the “theory” became a fact, were branded as scaremongering, fringe voices, best to be ignored. Then, of course, once the “theory” became “fact” it suddenly was perfectly obvious to everyone in retrospect.

But the bigger question, and what stumped the so-called experts, is how could something so vast, with so many moving pieces, remain a secret for as long as it did.

The answer is extremely simple:everyone who was in on the “secret” was also benefiting from it: from the lowliest Libor rigger to the CEO of Barclays and every other major bank, they all knew what was going on, but also knew that if the information became public knowledge, the jig would be up, and everyone’s benefits would evaporate with some even going to jail (at least in a hypothetical legal system in which bankers actually go to jail). In other words, it was merely a case where everyone’s interest was aligned to maintain the conspiracycartel as long as possible.

Which brings us to High-Frequency Trading: another vast “conspiracy”, this time involving market rigging and manipulation, which Zero Hedge also called out as early as April 2009, only to be mocked before it became a generally accepted fact that the “algos” manipulate and frontrun virtually any security that is traded on an exchange or over the counter. This culminated with Michael Lewis’ book “Flash Boys”, only unlike the Libor case, there was absolutely no response because unlike Libor, and then FX and then gold rigging, the Federal Reserve’s own activity often depends on its symbiotic collaboration with the HFT community’s upward momentum bias (by way of Citadel, a peculiar close relationship between the NY Fed and Citadel we have discussed in the past). That, and there was also no informant to turn sides with the Feds, and make a case that goes to the very top. At least not yet.

Because the catalyst that cracked the Libor conspiracy was when the members started to make less and less money, until ultimately the formerly golden goose was bled dry. At that point, their incentive to keep their mouths shut became nil, and in some cases negative. From that point on, it was just a matter of time before the regulators had a case against the conspiracy granted to them on a silver platter.

The same is now happening to high frequency trading, because in a market in which volumes are crashing to unprecedented lows, and where there are no longer whale accounts for the HFTs to frontrun, pardon “provide liquidity to”, there is no longer a need for as many HFT firms. And those firms which end up on the losing end of the technological arms race, now that there is not enough profits for everyone to go around, are suddenly incentivized to bust the whole criminal ring wide open. Or in the words of Louis XIV, “After me, the flood.”

Which brings us to a the case of HTG Capital Partners, Plaintiff v John Doe(s), defendants, case 15-cv-02129, Northern District of Illinois.

Who is HTG Capital?

Here is the firm’s description from the horse’s mouth, Chris Hehmeyer, its CEO:

HTG is a proprietary trading company that some might call an aggregator of traders and trading groups. We’re members of the exchanges, and we get financing from the banks.

We have a very diverse way of executing trades. We have colocated servers at the exchanges, at the facilities in Chicago, New York and London.We do high-frequency, automated FX trading. We have people that do OTC trades over the phone. We have people still in the trading pit and we have people who make trades with a click of the mouse. We also have people who do everything in between. We execute in a whole variety of ways, depending on the market.

We do very little equity securities. We trade a lot of different futures. In futures, we trade stock indexes, interest rates, commodities, crude oil, gold, silver, copper, cattle, soybeans, corn, sugar and cotton — we trade a lot of different commodities. We don’t trade a lot of futures options, but we certainly trade some, particularly interest rates, crude oil, metals, energy and FX options. So we trade a lot of different products. We even have U.S. government securities — that’s where we arbitrage the futures.

The last is particularly relevant, because the abovementioned lawsuit is precisely one in which the dirty laundry within the HFT cabal finally emerges. The irony: HTG is suing a group of unknown other HFT firms for “egregious manipulation” of US Treasury futures, i.e., spoofing – one of the biggest crimes the HFT syndicate engages in on a daily basis (we will let slide the delightful irony that HTF does not even know who to sue when considering thatHTG CEO Hehmeyer has been an outspoken proponent of anonymity in electronic trading and his “public campaign on the issue contributed to the decision by CBOT and CME to suppress identifying information in the clearing process for trades.” Yes, ironic).

What does HTG allege?

From the lawsuit:

This matter involves theegregious manipulation of the U.S. Treasury futures markets trading at the Board of Trade of the City of Chicago (“CBOT”), a designated contract market and a wholly-owned subsidiary of CME Group, Inc. (“CME Group”). Since at least January, 2013, and continuing through at least August, 2014, the Doe Defendant(s) engaged in an illegal form of market manipulation known as “spoofing” in the U.S. Treasury futures markets.The term “spoofing” refers to, among other things, the manipulative practice of entering bid or offer orders with the intent to cancel those orders before execution (these orders are hereinafter referred to as “Deceptive Orders”). Examples of spoofing include entering orders to create the appearance of false market depth or to create artificial price movements upwards or downwards. This practice enabled the Doe Defendants to manipulate the market to their benefit, and to the detriment of HTG and other market participants. This Complaint seeks to recover the financial losses HTG suffered as a result of the Doe Defendant(s)’ illegal activity.

Back to the abovementioned irony vis-a-visHehmeyer’s vocal support of HFT anonymity:

Plaintiff does not know the identity of the Doe Defendant(s) because trading on the CME Globex platform is anonymous. For that reason, Plaintiff does not know the precise number of Doe Defendant(s). However, Plaintiff believes (based on the distinctive signature associated with the trading activity) that one party is likely responsible for most of the spoofing at issue in this Complaint. Moreover, allegations as to the Doe Defendants’ entry of orders are made on information and belief as the actual identity of the entity entering the orders is not known to HTG.

Actually it turns out there is no such thing as true HFT anonymity:

CME Group requires all CME Globex operators to identify themselves by the submission of a unique operator identification. Therefore, CBOT and/or CME Group are able to specifically identify the Doe Defendant(s), and Plaintiff will be able to obtain the Doe Defendant(s)’ identities through discovery. Plaintiff will request leave to amend this Complaint upon learning the identity of the Doe Defendant(s).

Actually, we know precisely HTG thinksthe Doe Defendent is. Recall that it was back in August of last year when the sameHTG accused rival Allston Trading, “of manipulating prices on CME Group Inc.’s exchange” vis spoofing – the same allegation that has resurfaced seven months later in this lawsuit.

Only back then it wasn’t an actual lawsuit, and HTG stopped merely with arbitration: “HTG Capital Partners LLC filed an arbitration case against Allston with CME, saying it detected a pattern of canceled bids and offers meant to mislead other traders into moving prices favorably for Allston, according to the people, who asked not to be identified because the case is private. Exchanges prohibit creating the appearance of false demand and then canceling orders,a practice known as spoofing.”

But… that’s ironic, because all those defendants and lobby adherents to high frequency trading swear up and down the NYSE’s brand new laser transmitter that they never, never spoof. After all that is clearly illegal. Well, apparently, they do. And now, thanks to one of the biggest insiders in the HFT industry, it is on the public record. Worse, as this case gets more prominent, and once the discovery trickles in, it is pretty much game over not only for Allston’s spoofing strategy, but at that point the SEC, CFTC, and eve FBI will have no choice bu to finally crack down upon the industry, in a rerun of what happened in the Libor manipulation fiasco when one after another bank were exposed as manipulators of a grand scale.

And since an insider makes the allegations, it will be impossible to sweep them under the rug.

Incidentally, one must wonder just how bad things for HTG must have turned out, if the firm was ready to take this desperate, terminal step. Because after this, the party – as Virtu and BATS know it – is over. Sadly for both Virty and BATS, they never managed to go public in time. And now the party is almost over.

Back to the lawsuit, which goes in exquisite detail as to just how HFTs spoof (yes dear HFT-defending lobby: how you spoof everyone else):

The Doe Defendant(s) accomplished their spoofing activity by submitting Deceptive Orders into the CME Globex platform which they intended to cancel before execution. By submitting Deceptive Orders, the Doe Defendant(s) lured other market participants (like HTG) into selling contracts below, or buying contracts above, what would otherwise be the prevailing market price. These Deceptive Orders created the false appearance of market pressure in a certain direction (to either buy or sell). The Doe Defendant(s) then “flipped” the market by canceling their Deceptive Orders and virtually simultaneously entering an order in the opposite direction at the same price.

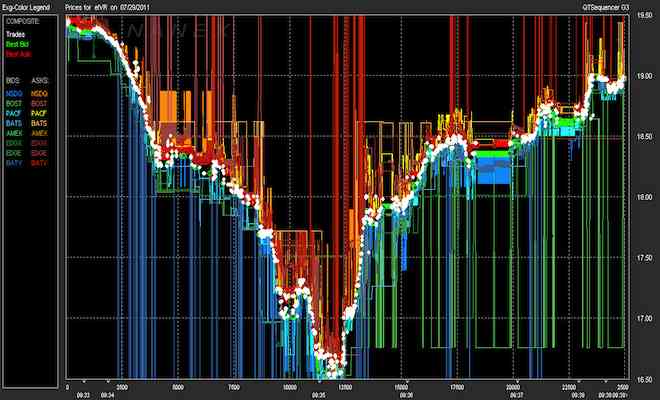

In this case, the Doe Defendant(s)’ spoofing is characterized by a unique signature: a well-defined pattern consisting of three phases. In the first phase, the Doe Defendant(s) would enter Deceptive Orders that they intended to cancel before execution (the “build-up” phase). These orders were deceptive because the Doe Defendant(s) intended to cancel the orders before they could be filled; they created the false appearance of market depth, which, in turn, caused unwitting market participants to react by entering buy or sell orders in the same direction as thefalse momentum. In the second phase, the Doe Defendant(s) canceled the Deceptive Orders they had entered during the build-up phase (i.e., the “cancel” phase). In the third phase,virtually simultaneous to the cancels, the Doe Defendant(s) would enter one or more orders in the opposite direction of the Deceptive Orders and at the same price, trading against the remaining available contracts at that price, thereby “flipping” the market (the “flip” phase).

It is this well-defined, three-phased pattern that demonstrates that the Doe Defendant(s)’ entered orders with the intent to cancel those orders before execution. Indeed, the frequency and speed with which the build-up, cancel and flip progression took place eliminates the possibility that this pattern was anything other than orchestrated. The Doe Defendant(s) could not have legitimately changed their mind as to the direction of the market so quickly, so often, and with such precision.

Visually this looks as follows:

It gets worse, because if enough people raise a stench about this HFT spoofing, there will certainly be a major criminal case out of it. Why? Because the security involved is the very lifeblood of the US – Treasurys, which the Doe Defendants “attacked.”

Finally, the Doe Defendant(s) three-phased pattern appears to be a coordinated attack across the U.S. Treasury markets.The Doe Defendant(s) often implemented the three-phased pattern in multiple U.S. Treasury products at the same time. All of the above is strong evidence that the Doe Defendant(s) entered orders that they intended to cancel prior to execution.

It gets worse: according to HTG this “attack” is coordinated, wholesale assault on the most vital US security:

HTG has identified thousands of instances of illegal spoofing in which it was damaged in the CBOT five (5), ten (10) and thirty (30) year U.S. Treasury futures markets during the 2013 and 2014 calendar years. To put this in perspective, if the Doe Defendant(s) had profited by just one “tick” in the three examples shown above, the Doe Defendant(s) would have generated profits of $6,125, $17,718 and $17,906 respectively.

There is much more in the full lawsuit (link), and we encourage readers to go through it as this may well be the landmark case that topples the entire house of manipulated, high frequency cards down.

As for the future of HFTs, we promise not to shed many tears: as readers know, our crusade since 2009 has been to uproot and destroy any and every HFT parasite in existence. And since it became abundantly clear that the regulators are as corrupt and complicit in the crimes of the HFTs as the actual perpetrators, we became resigned that we would have to wait until the next, and truly historic, market crash which the Fed would try to pin on the HFTs, in the process purging the market of its biggest structural cancer.

Now, however, it appears we won’t have even that long to wait: because the parasites are turning on other parasites, and the only thing missing is for the weakest link to spill all they know to the next Michael Lewis, or the next Ferdinand Pecora, in the process finally bringing the hammer of creative destruction upon the vacuum tubes.

We for one, have our popcorn ready.